Medicare Advantage (MA) seems to be the belle of the healthcare ball, attracting more seniors than ever. A recent Commonwealth Fund survey aimed to unveil the supposed "value-added" services of MA over traditional Medicare, but is the MA magic more of a sleight of hand than a genuine healthcare marvel?

Medicare Advantage (MA) continues to attract more Medicare-eligible beneficiaries. A new survey by the Commonwealth Fund sought to identify the “value-added” services provided by MA over traditional Medicare.

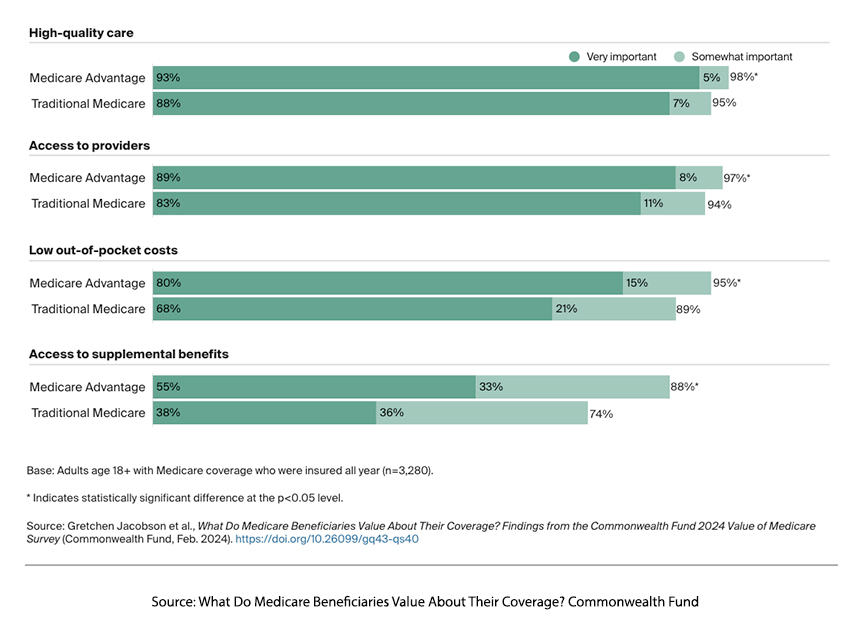

Beneficiaries signing up for MA value these programs for their high-quality care, access to providers, low out-of-pocket costs, and access to supplemental benefits. But is that what they are getting? It is difficult to define quality; often, what a physician considers quality care may differ from that of a patient. However, as you can see from the numbers, despite a statistical difference, both MA and traditional Medicare beneficiaries valued access to providers and high-quality care. So, the following survey question is interesting regarding how those expectations were met.

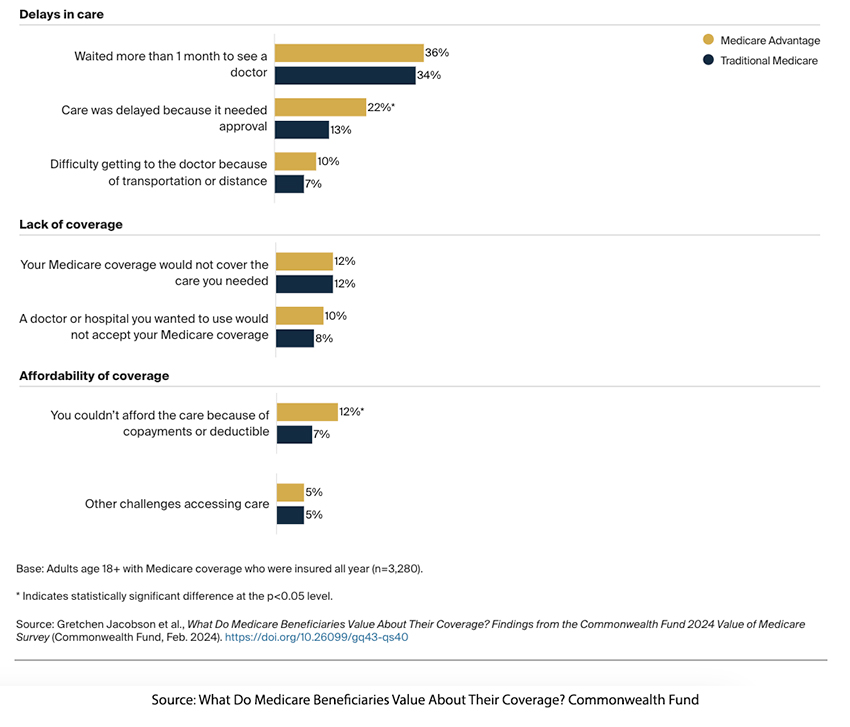

MA beneficiaries had care delayed awaiting “approval” compared to those in traditional Medicare and more frequently couldn’t afford the care because of plan co-payments or deductibles. The difficulty in getting to the physician’s office and the doctor or hospital the beneficiary wanted not accepting their coverage is part of the Faustian bargain made. MA plans offer more narrow networks of care.

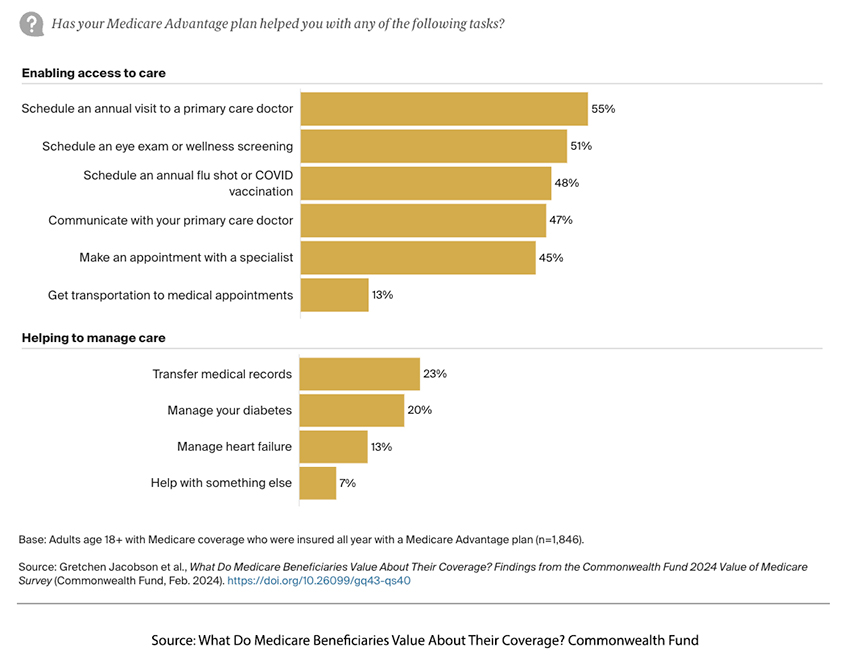

MA programs provided additional care in scheduling appointments, screening examinations, and flu and COVID vaccinations. However, as the Commonwealth Fund points out,

MA programs provided additional care in scheduling appointments, screening examinations, and flu and COVID vaccinations. However, as the Commonwealth Fund points out,

“Some visits and screenings, such as for flu vaccines and eye exams, are tied directly to the quality-bonus payments that MA plans can receive. Wellness exams and primary care visits, meanwhile, can help ensure that beneficiaries receive many of the other tests that are linked to plan payments.”

So, depending upon your degree of cynicism, in this instance, the patient's and MA's incentives are aligned, or this is just another means of increasing revenue. Roughly 20% of all Medicare beneficiaries have diabetes, and as you can see from the chart, 20% of those beneficiaries receive help in managing their care. A more rigorous view published in Diabetes Care found that,

“Leveraging data from >300,000 older adults with diabetes in a national outpatient registry, we found that those enrolled in MA had greater access to preventive care than Medicare FFS enrollees. However, MA beneficiaries had modestly but significantly poorer intermediate health outcomes and were less likely to be treated with newer, evidence-based antihyperglycemic therapies compared to Medicare FFS beneficiaries.”

About a third of MA beneficiaries have heart failure. A study in JAMA reported:

“Among patients hospitalized with heart failure, no observable benefit was noted in quality of care or in-hospital mortality between those enrolled in MA vs. FFS Medicare, except lower use of post–acute care facilities.”

To be fair, ambulatory or outpatient care for heart disease in MA beneficiaries is better. As reported in a meta-analysis by the Kaiser Family Foundation

“Among beneficiaries with heart disease, Medicare Advantage enrollees were more likely than those in traditional Medicare to receive guideline-recommended therapies in ambulatory settings, but there were no differences reported in inpatient settings.”

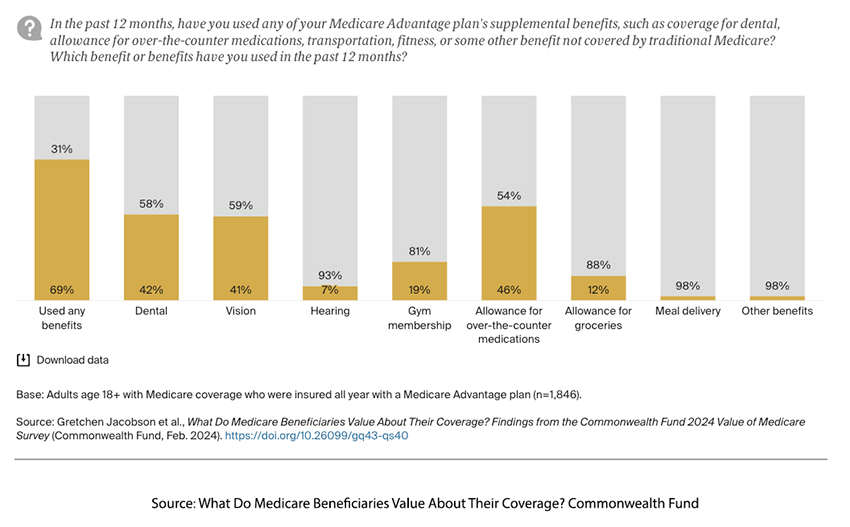

Few MA beneficiaries took advantage of the dental, vision, and hearing services provided. Even though more MA beneficiaries qualify based on income or disability to receive Medicaid (dual-eligible), few MA beneficiaries use a grocery allowance or meal delivery. The most significant additional benefit was the purchase of OTC medications.

What is the MA magic?

It seems that few of the qualities most valued by beneficiaries enrolled in MA programs are met. Still, MA programs are increasingly popular, providing 51% of Medicare coverage this year. This may be due to a variety of reasons. First, about 20% of MA beneficiaries receive coverage as part of union or company retirement programs. Second, individuals are more price-sensitive than quality-concerned. This can be especially true when price and quality are more difficult to define. No summaries of your health expenditures can be easily compared to alternate plans. 73% of MA beneficiaries pay no premiums other than their Medicare Part B premium – this is a very big selling point.

Or perhaps it is a sunk cost fallacy when you are reluctant to abandon a strategy because you are heavily invested financially, emotionally, or time-wise, even when it is clear that abandonment would be more beneficial. Nearly half of all MA beneficiaries switch to other plans within five years of enrollment. This churn of beneficiaries works to the advantage of MA programs; they only need to concern themselves with the short-term needs and care of their beneficiaries. In half the cases, another MA contractor will address the long-term problems.

There is no magic. Those extra benefits, vision, dental, etc., are used by less than half of the MA beneficiaries. MA receives a $2,350 per enrollee rebate above the estimated cost of Medicare services. The cost of Medicare services is based on the risk profile of the MA beneficiaries. The Office of the Inspector General estimated that 2020 MA programs billed $2.6 billion for diagnoses unrelated to any clinical care provided.

While Medicare Advantage programs offer enticing benefits, the survey suggests a need for a more critical examination of the alignment between perceived value and actual outcomes and a deeper consideration of the financial implications for both beneficiaries and the healthcare system.

Source: What Do Medicare Beneficiaries Value About Their Coverage? Commonwealth Fund