I have written frequently about hepatitis C. First, during my former career in drug discovery research, I spent 10 futile, frustrating years working in this area. Second, the quarter-century campaign that led to a cure for the infection is unquestionably one of the most impressive accomplishments in the history of medicinal chemistry (1).

I have also written about the benefit of second- and third-generation drugs, which are dismissed as "me-too" drugs by know-nothing critics of the industry, such as Sidney Wolfe and Marcia Angell. Ignorant critics would have you believe that the fourth approved drug in a class is nothing more than a non-innovative cash cow for drug companies. They could hardly be more wrong.

It is now clear that patients benefit greatly when there are multiple choices of drugs for a particular ailment; not just medically, but also economically. There can be no better example of this than AbbVie's Mavyret, the newest weapon in the already-impressive arsenal against hepatitis C—a pernicious virus that has infected 3 million people in the US and 170 million worldwide.

The road to a cure for HCV was long, uphill, and full of potholes. It took 22 years from the time of discovery of the virus until the first two direct-acting antiviral HCV drugs were approved. Yet, these two drugs had little time in the limelight. (See: In Drug Discovery, Even When You Win, You Lose.) Within a year of their approval, they began to fall out of favor as physicians looked ahead and saw Gilead's Sovaldi—the $1,000 per pill drug (2), which became the first of many drugs or drug combinations to successfully eradicate the virus (3). (Even at $1,000 per pill, Sovaldi was a pretty good deal considering what it accomplished, especially by comparison to the older, also expensive and tortuous treatment that it replaced. See: Sovaldi $84,000 And Still Quite A Bargain.)

When Sovaldi hit the pharmacies in 2013, it wiped out its competition. Merck's Victrelis, despite being the first approved drug, got absolutely mutilated. The company lost a fortune by being successful - developing the first direct-acting anti-HCV drug. Vertex's Incivek did well for a year but then fell off a cliff. Neither is used today. Ironically, Gilead is now facing the same pressure as did its predecessors. In 2016 the Sovaldi sales had plunged to $4 billion, 60% lower than the $10.3 billion it sold in 2014 - all because of competition.

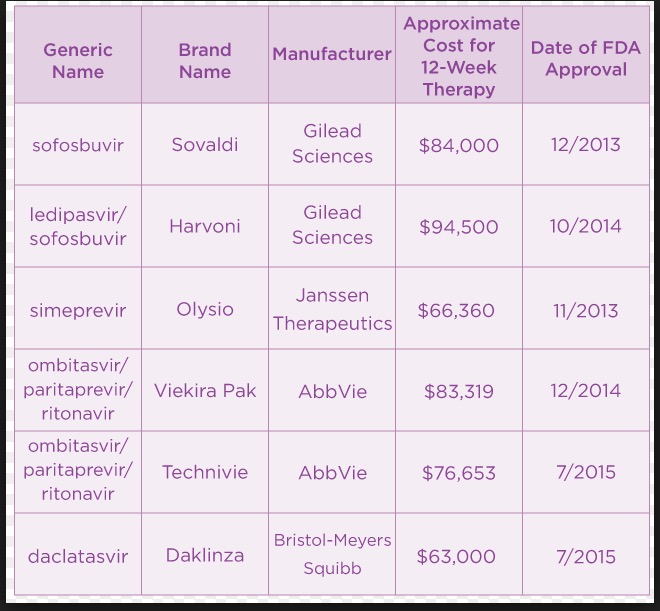

Given the enormous number of infected people and the quantum leap in the technology that resulted in Sovaldi, it was inevitable that second-generation drugs would follow. They did. There are now 9 direct-acting antiviral drugs (or drug combinations) on the market. Not only are the newer drugs more effective than Sovaldi, but they are also less expensive - especially the newest, Mavyret which was approved in August 2017. AbbieVie set the price of a full course of Mavret at $26,400 (4), which is significantly lower than the others.

Direct-acting HCV antiviral drugs and their prices (as of 1/16). Zepatier and Epclusa, which were approved in 2016, are missing. These prices are no longer accurate.

The drugs in the chart above have cure rates close to 100%, something which could not have even been imagined even a decade ago, and they are getting cheaper. Competition works. So does medicinal chemistry.

Notes:

(1) Medicinal chemistry is a branch of organic chemistry that is focused on discovering and developing new drugs. It is the combination of the skills of synthetic organic chemistry and pharmacology.

(2) The price is not really $1,000 per pill. That was the announced price, which bears little resemblance to the actual price that pharmacy benefit managers will end up paying the company. Roughly half.

(3) Unlike HIV, HCV can be completely eliminated from the body. This is a cure, also referred to as a sustained virologic response (SVR). A SVR is attained when there is no detectable virus 12 weeks following the end of treatment.