The Medicare Diabetes Prevention Program initiated last April is structured group education for patients, based upon widely accepted guidelines [1] to teach a healthy lifestyle and reduce body weight by 5% (10 pounds for a 200 lb individual). At last, prevention before treatment and as part of paying for performance suppliers are reimbursed based upon attendance and weight loss. But a new report raises concerns that the ounce of prevention may not be appropriately compensated and we will not see that pound of cure.

The study reports on the actual costs and remunerations for a safety-net health care system. [2] The curriculum consists of 16 weekly to bi-weekly sessions in the first half of the year, with monthly meetings in the remainder of the year. To best serve the needs of patients, classes were offered at multiple locations and times. Lay educators were trained to act as coaches, supervised by certified diabetes educators and a health psychologist. Patients were at-risk for diabetes having had gestational diabetes or a current HgA1c >5.7, both conditions considered pre-diabetic. Patients were cared for free of charge and did not receive financial incentives to participate. Of the patient recruited 18% were Medicare beneficiaries that are the basis for the reporting.

How well is their program working

The table shows what Medicare offered as payment, the number of beneficiaries meeting a programmatic goal and a per beneficiary measure of what the hospital actually received. [3] Two things stand out, the attrition rate is steep, and the goals are challenging to meet, only 4.7% successfully completed the meetings and weight loss. Because of the lack of sustained participation, their payments are a small fraction of their potential

The table shows what Medicare offered as payment, the number of beneficiaries meeting a programmatic goal and a per beneficiary measure of what the hospital actually received. [3] Two things stand out, the attrition rate is steep, and the goals are challenging to meet, only 4.7% successfully completed the meetings and weight loss. Because of the lack of sustained participation, their payments are a small fraction of their potential

64% of participants were women, 40% Hispanic, 33% Black, 27% Caucasian with a mean age of 60. They went to an average of 8.6 meetings, had a mean weight loss of 1.8%. The average payment to the hospital was $138.

What are we spending

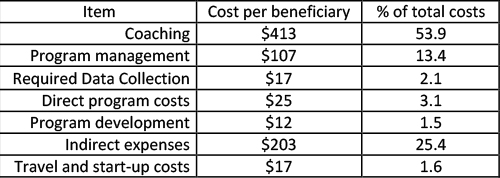

The authors calculated their per beneficiary expenses, to get the program off the ground and run it for the length of the program, one year. I put those expenses into a table.

There are a few items worth noting, particularly program management and indirect expenses. Program management, another word for administrators, is 13.4% of their costs, you can determine whether that is or is not appropriate. Indirect costs are more problematic; they reflect how much of the hospital's overall costs, e.g., heating, lights, security, maintenance is attributed to this program. It is the line item where administrators can assign more or less, making a program look better or worse. Indirect costs should always raise questions. The total, approximately $800 a beneficiary; we can quibble about how much is overestimated or inappropriately attributed, but the costs exceed the revenues. It is tough for any hospital to run a program at a loss, but this is particularly true for safety-net hospitals.

To justify the program, at least financially they have to show a more significant benefit, and for that, they turn to the “savings” that prevention will provide by decrease spending elsewhere. The cite another study showing that these programs could save $1112/beneficiary annually over a three year period, a return on investment of 2.96 – meaning for every dollar spent, you save nearly three dollars. [4] But if you actually look at the citation, savings only occurred in the first three-quarters of that program and were predicated upon the amount of weight loss. This is not a faithful use of data, and its citation is bending if not obfuscating the referenced work. One can argue that in a report on healthcare finances, that the authors have not been faithful to their fiduciary responsibility.

Prevention is important, it can save money, but demonstrating those savings requires assumptions that may not be met. This report shows that bringing about changes in patient lifestyle is more easily said than done and that it will cost more than we are currently willing to spend.

[1] National Diabetes Prevention Program developed by the CDC

[2] Safety Net Hospitals a hospital with the “legal obligation to provide health care for individuals regardless of their insurance status … and regardless of their ability to pay.”

[3] This number is a bit off the mark as it assumes payments for the entire cohort which rapidly decreases in time, but since their costs are is based upon treating everyone it allows an apple to apple financial comparison.

[4] The return on the investment for the program they are reporting is negative for every dollar spent, they lose $1.72

Source: New Medicare Diabetes Prevention Coverage May Limit Beneficiary Access and Widen Health Disparities Medical Care DOI: