McDonald's. Dell. Chrysler. Rolls-Royce. Sears. Trump. All are companies that bear the names of their founders. Does that matter? One would think not, as Shakespeare told us, "A rose by any other name would smell as sweet."

But new research published in the American Economic Review begs to differ. The authors, all from Duke University, claim that eponymous companies (i.e., companies named after their founders) are more successful than others.

In contrast to Shakespeare, the authors had a different hypothesis: A founder who names a company after himself is sending a signal to the market. That signal, essentially, is: "I'm such an incredibly talented person, that I guarantee my firm will succeed. To prove I mean what I say, I'm going to put my name and reputation on the line by naming the company after myself." The founder, therefore, is taking a calculated risk. If the company succeeds, his name/reputation will be enhanced; however, if it fails, his name/reputation will be ruined.

To conduct its analysis, the team first crafted a model that expressed in mathematical equations the relationships between several factors, such as the entrepreneur's ability, the entrepreneur's signaling (i.e., naming the company after himself), and the public's perception of the quality of the company. From these, they derived two hypotheses: (1) Eponymous firms perform better; and (2) Entrepreneurs who have rare names are less likely to name a company after themselves, but the ones who do have even more success1.

To test their hypotheses, the authors gathered financial data on over 1.8 million private and public European firms from 2002-2012. About 19% of the firms were eponymous, and the mean age for both eponymous and non-eponymous firms were roughly the same (~15 years).

They determined company performance by calculating the return on assets (ROA), which gives a measure of how efficiently a company is making money given the amount of assets it possesses2. In their data set, the average (mean) ROA of eponymous companies was 7.8%; for other companies, it was merely 4.8%.

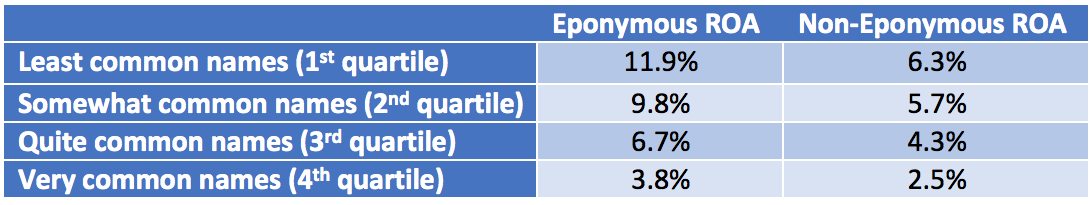

The data verified their second hypothesis, as well. Entrepreneurs with common names were more likely to name the firm after themselves, while entrepreneurs with unusual last names were least likely to do so. Once again, when stratified by name commonality, eponymous firms were more successful than non-eponymous firms3. (See table.)

Even though entrepreneurs with rare names were least likely to name the companies after themselves, the ones who did were rewarded. They had the best ROA of all (11.9%). Interestingly, the same pattern held true for non-eponymous firms; that is, if the owner had an unusual last name, it was likelier to perform better than firms who have owners with common names.

Thus, the authors conclude, the data supports their hypothesis that talented entrepreneurs name companies after themselves as a way to signal to the market that they will be successful4.

There are at least two potential objections. First, it is possible that entrepreneurs who name a company after themselves simply work harder than other entrepreneurs. That possibility cannot be ruled out from this data.

Second, ROA is not the only measure of company performance. Other common indicators include return on equity (ROE) and return on invested capital (ROIC). Company success can also be compared through their enterprise value (EV), which is the amount of money it would take to buy out a company. Public companies are further evaluated by market capitalization, stock price, and the P/E ratio. The authors should examine such figures to verify that their hypotheses are still upheld.

It is worth noting that the team's research indirectly contradicts the conventional wisdom that firms should not take on their founders' names because it harms the resale value. Even if that is still true, a higher ROA may offset that.

Notes

(1) Why would an entrepreneur with a rare name be less likely to name a firm after himself? The authors surmise that a person with a rare name is under even greater pressure for his firm to succeed. After all, if your last name is Hasenpfeffer and your firm collapses, people will likely remember that.

(2) The equation for return on assets (ROA) is: [Net income + Interest expense] / [Total assets]

(3) Name commonality for non-eponymous firms was based on the name of the owner.

(4) This video nicely summarizes the authors' methodology and results.

Source: Sharon Belenzon, Aaron K. Chatterji, Brendan Daley. "Eponymous Entrepreneurs." Am Econ Rev 107 (6): 1638-1655. Published: June 2017. doi: 10.1257/aer.20141524