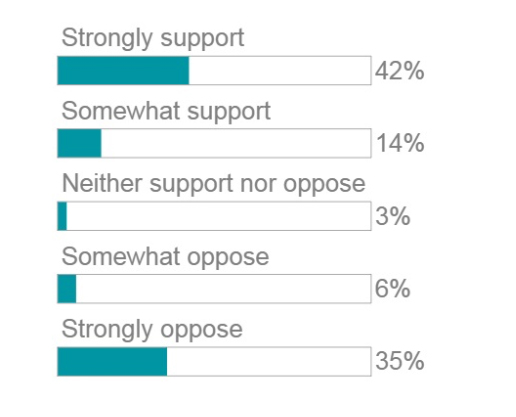

Merritt Hawkins, a company that specializes in recruitment and placement of physicians, released a survey of 1,033 physicians (a 1.5% response rate) asking whether they supported a ‘single payer’ health care system. They point out that support for such a system has grown from 42% in 2008 to 56% today (measured by both somewhat and strong support) while opposition has decreased from 58% in 2008 to today’s 41%. The company goes on to suggest four reasons why physician attitude is changing.

Merritt Hawkins, a company that specializes in recruitment and placement of physicians, released a survey of 1,033 physicians (a 1.5% response rate) asking whether they supported a ‘single payer’ health care system. They point out that support for such a system has grown from 42% in 2008 to 56% today (measured by both somewhat and strong support) while opposition has decreased from 58% in 2008 to today’s 41%. The company goes on to suggest four reasons why physician attitude is changing.

- “Many of them believe that a single payer health care system will reduce the distractions and allow them to focus on what they have paid a high price to do: care for patients.”

- “As the new generation of physicians comes up, there is less resistance among doctors to single payer.”

- “…physicians believe we are drifting toward single payer and would just as soon get it over with.”

- Physicians now feel “we should make an effort to cover as many people as possible.”

Even though there were few survey respondents similar surveys by LinkIn and the Chicago Medical Society demonstrated similar results.

But what do these physicians or in fact policy makers mean by single payer? Well, the best description is that already in use, ‘Medicare for All’ – that is, the federal government would cover all health care costs, determining what costs are covered, what co-payments and deductibles are to be made and what providers, hospitals, and physicians are paid. And the federal government will pay those bills through taxation. To be honest, the government has been an increasingly large single-payer for many years. They wholly own, administer and finance the Veterans Administration’s healthcare system – a more socialist single-payer system where the means of production (that would be hospitals and all the necessary providers) is held ‘by the people.’ And the federal government funds Medicare and Medicaid, which pays privately held hospitals and providers. On the other end of the spectrum are private sources of payment, traditionally health insurance provided by your employer as a funded benefit. [1] The Affordable Care Act (Obamacare), in part, provides government subsidies to make this insurance affordable. Switzerland has successfully used this mechanism. Medicare has also experimented with hybrid payment programs, combining private and public funding. Medicare Advantage pays insurances companies a fixed rate for each covered patient, the insurance companies obtain additional monies from their beneficiaries and pay hospitals and physicians a portion of the total they collect. This type of system has worked well in Germany.

And if this is confusing then note that this is the simplified explanation, but like all policy, it involves some tradeoffs. For patients, based on the Medicare model you pay an annual premium and have defined deductions and co-payments. It ain’t free, but it is heavily subsidized, in part, through taxes you paid while employed. But you can access and more importantly afford healthcare. It is also likely that the government will make those subsidized costs means tested – that is the wealthier will pay more than the less well off.

How about the payers, what does a single payer system provide them. For those of us with employer provided coverage it may mean more money in your pocket as those health care costs are paid as salary rather than as a benefit. It will increase your taxes as those monies will only sit in your pocket for a little while on their journey to the government. [2] It will take away a large part of the insurance companies business model but before you cheer for the end of evil insurance companies note that they employ over 500,000 people and most would be looking for new jobs. Now insurance companies and some of their employees could survive a single payer system by acting as administrators for the government’s program, after all, the insurance companies are already getting paid to administer the Medicare program for the government. But their profit margins would continue to be set by the government.

And for providers a single payer system would eliminate the paperwork of identifying and collecting payments as well as navigating multiple approval systems and payment plans – it would give their incomes a rational, stable, predictive basis. On the other hand, the government would regulate the prices they could charge. Medicare does not allow physicians to charge patients more than 10% above Medicare’s defined payment, and they make that 10% harder to collect. [3] The big winner here is the American Medical Association who as we have discussed receives the bulk of their income determining physician fees for Medicare while representing fewer and fewer physicians.

Healthcare costs are increased by administrative costs involved in collecting monies from patients and paying their providers. Single payer systems may well reduce those administrative expenses and will certainly make the system easier for patients and providers to navigate. But the largest rise in health care costs is not administrative or "waste." Costs are increased because we cover more, our research has turned the lethal disease into chronic illness (HIV is a great example, but the same can be said for many cancers or even renal failure) and we have a rising population. Single payer is not a panacea; it comes with tradeoffs.

[1] This approach is a vestige of price control during World War II when employers could not raise wages but had an economic advantage by providing health care insurance as a benefit. Businesses received a tax write off in making this benefit an expense and workers received a non-taxed benefit rather than additional income.

[2] One should expect both federal and state taxes to increase as Medicaid is partially funded by the states.

[3] Physicians ‘participating’ in Medicare accept Medicare fees in full with 80% paid directly by Medicare to the doctor and the remaining 20% captured from patients' as copayments. Physicians not participating in Medicare can charge 110% of Medicare’s payment, and the check is sent to the patient with the doctor having to collect their payment from them.