One of the most challenging portions of Medicare for beneficiaries to wrap their heads around is the Part D Pharmaceutical Coverage – helping to pay for medications. Part D has three phases, the initial coverage, catastrophic coverage and that in between land, the DONUT HOLE. In the initial period, beneficiaries pay out-of-pocket 25% of the “cost” of their medications. In the catastrophic phase, currently defined as more than $5,000 in drugs, beneficiaries pay only 5%. The Donut Hole refers to that period in between when expenses are more than $3,750 and less than $5,000 – here beneficiaries pay more out of pocket, 35% for brand names and 44% for generics.

Not quick before your eyes glaze over, know that Congress has played a bit with the numbers through several legislative cycles because this version of payments is set to end in 2019. And as you would expect, beneficiaries through AARP, insurance companies and manufacturers are at odds as to the changes. Briefly, the donut hole goes away this upcoming year, some new percentages of co-payments are placed, and costs are shifted between those stakeholders. Let’s start with beneficiaries.

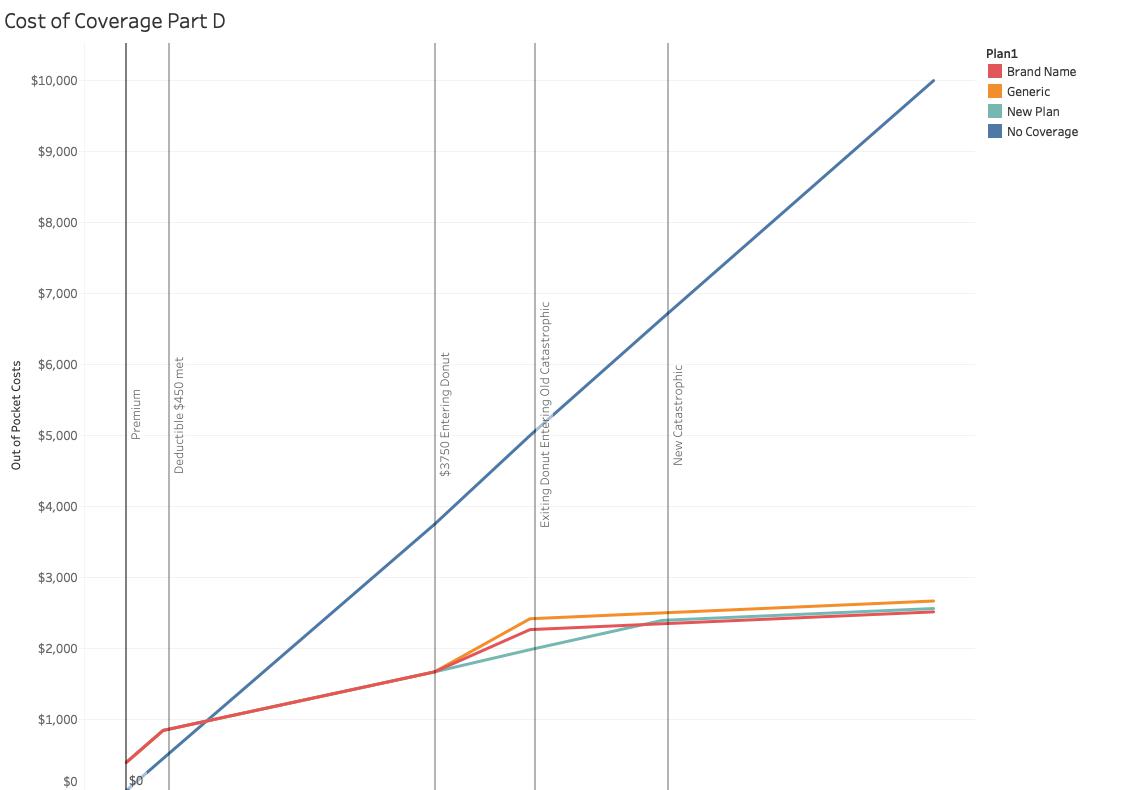

I have plotted out-of-pocket costs for medicines through $10,000, the graphics do not change for higher spending. That solid blue line is the out-of-pocket expenses of someone without Part D coverage. What appears to be a solid red line until entering into the Donut are both the current and proposed plan. Two things are clear, Part D is a good deal as your expenses mount – you get a sense of how good a deal, by the widening gap between the blue and red lines. Second, if your medications cost less than about $800 annually, Part D coverage is more expensive than just paying the price at the counter – because of the premiums and $450 deductible charged for Part D coverage. [1]

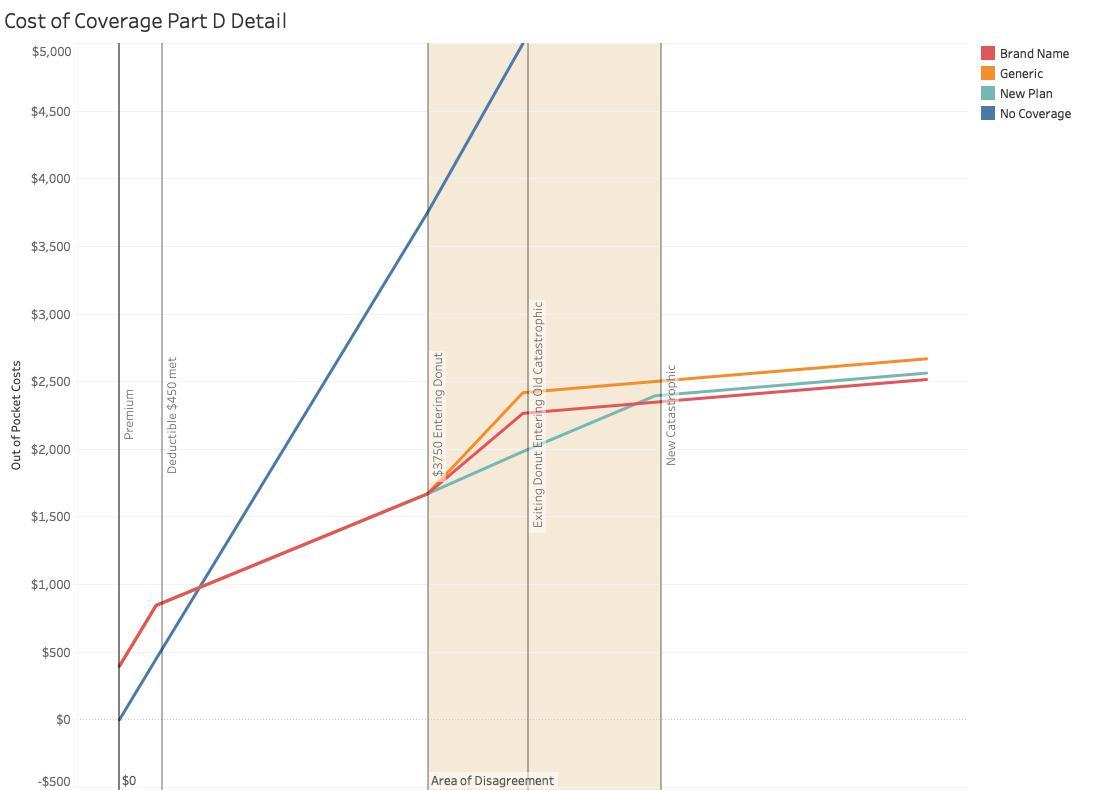

The same graph with the vertical access enlarged to look at the Donut hole and the changes for beneficiaries. The orange and red lines are the current plans; orange for generic drugs, red for brand name. You might ask why brand-name drugs have lower out-of-pocket costs than less expensive generics, but remember we are only talking about dollars, not courses of treatment, generics “stretch” your dollar by purchasing more extended periods of treatment. The turquoise line is the new plan, and it seems that it represents considerable savings over the old plan; it does. AARP’s concern is for beneficiaries with greater than $5,000 in expenses because that threshold is being increased; they will pay an additional $330. The disappearance of the Donut Hole is for brand-name drugs in 2019 and for generics in 2020; so AARP may have a legitimate concern about the effect upon those using generics, presumably less able to afford or desire brand names.

The real fight is between the insurance companies and the manufacturers. To understand that just go back for a minute to the first graph. The ever-widening gulf between the blue and turquoise line is the amount covered by the insurance companies – well sort of, kinda, maybe. Under the old Part D plans, insurance companies received a 50% cost reduction from manufacturers for those brand-name drugs, so their share of costs were about 15%. Under the new rules, manufacturers will cover 70% reducing insurance companies costs to just 5%. Apparently, the manufacturers, Big Pharma, is not pleased. And for those costs in the catastrophic period, now or in the legislated future, the 95% it seems that insurance pays actually include 80% covered by Medicare. , Insurance companies tell a better story of their altruism than the numbers actually show.

And one last consideration, all of these calculations and numbers are based on the “cost” of the medications, numbers that are ambiguous at best. If only there were someone who monitored what we were paying at the pharmacy, CVS comes to mind. And if only we could look at what the insurance companies were paying for diabetes or heart failure, we might be able to make some real progress in understanding and then controlling our expenses. Maybe Aetna knows. And here is the unintended consequence, in a short while CVS and Aetna will be one and they will know. To whom do they owe fiduciary responsibility, beneficiaries, and customers or their stockholders?

[1] Not participating in Part D works for a while, but if you need more and more medications as you grow older you pay a penalty for not participating in Part D from the beginning. The Man always finds a way to curtail bargain hunting.