Medicare, Parts A and B, provide coverage to the eligible, those over 65, and those who qualify because of a specific illness, like end-stage renal disease or due to income limitations, with coverage for hospitalization and physician care. In exchange, those beneficiaries pay monthly premiums and certain out-of-pocket costs.

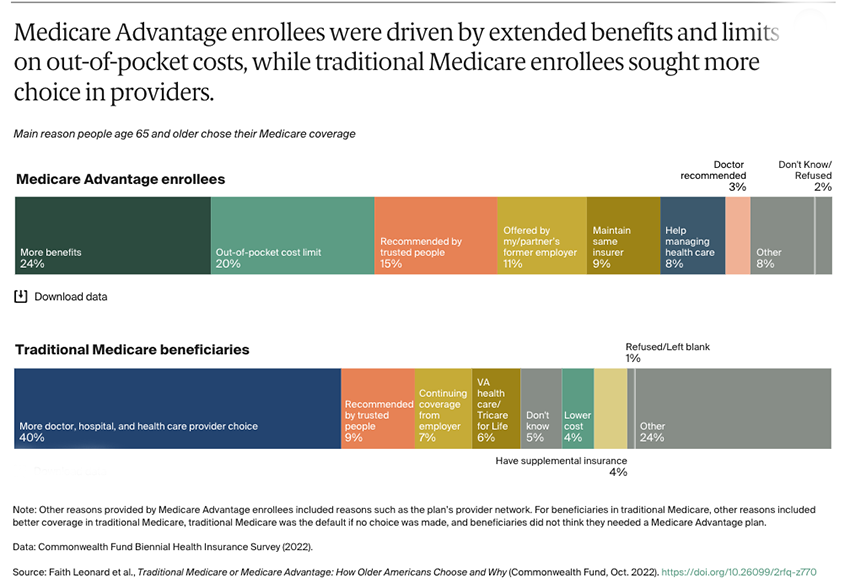

Medicare Advantage, Part C, provides the same coverage as regular Medicare and certain additional services, like dental coverage. Their cost is somewhat lower than the premiums and out-of-pocket costs of Medicare, making them financially attractive to everyone on a fixed income. But the network of physicians and hospitals that can provide your care is more limited. The Commonwealth Fund captures the difference between the two plans and how seniors choose quite nicely.

Traditional Medicare provides more choices of where and whom to receive care from. Medicare Advantage restricts your choices somewhat but reduces your costs.

More Services At Lower Cost – The Mathmagic of Medicare Advantage

To be fair, if I am signing up for Medicare Advantage, what fiscal magic they perform to lower my costs while providing me with more is not important. There is no magic. The Medicare Advantage programs use two effective means to reduce costs and increase payments. First, they contract with hospitals and physicians to provide services for their beneficiaries – that is why the choice of these services is restricted. And they do not pay the hospitals or physicians the full amount they might have received from Medicare directly – they skim some of the hospital and physician charges.

Why would a hospital or physician agree to this arrangement? That depends on how many Medicare Advantage beneficiaries are within your catchment area. 40% of beneficiaries choose Medicare Advantage, and that number is growing by about 10% annually. So if you provide care in an area where the predominant insurance plan is Medicare Advantage, you must sign those contracts. Otherwise, you will see far fewer patients – after all, a skimmed Medicare payment is still better than none at all.

Medicare beneficiaries are a mixed group; some have few medical needs, and some have many. Rather than pay the Medicare Advantage programs a fixed amount for each beneficiary they enroll, Medicare requires that the Medicare Advantage programs calculate how “at-risk” their patients are and will pay more for those requiring more care. Seems fair. Of course, at risk is often in the mind of the beholder. It will not come as a surprise that the insurance companies would like to have more at-risk beneficiaries on paper and fewer in reality – it generates more income for them. And every one of the Medicare Advantage programs has been found with its hand in that particular cookie jar, upcoding the beneficiaries' severity of illness. This year it is Cigna who got caught.