To understand healthcare policy, an area of expertise of my colleague Dr. Chuck Dinerstein, one must have a basic grasp of economics, the dismal science. One particularly important aspect is how prices (and wages) change over time.

When I was little, I remember my grandpa -- legitimately, the most interesting man in the world -- telling me about how he could buy things much more cheaply years ago. Coffee? He could get that for a nickel. (I wonder what he would think about $7 lattes.) His gripe, echoed by Old Timers everywhere, was that money wasn't worth as much as it once was. Yogi Berra summed it up best: "A nickel ain't worth a dime anymore."

They're absolutely right. They were both describing the economic concept of inflation, in which prices slowly rise over time. But what my grandpa and Yogi failed to appreciate is that they were also making more money over time. That's one reason inflation occurs in the first place.

Every year, you expect a raise, right? Well, so does everybody else. As salaries increase, so does the price of goods. Why? Because as people make more money, they buy more stuff, which increases demand (and prices). Also, businesses are paying their employees (who also want raises) more money, and they must increase the prices of their products to recoup those costs. All of this conspires to increase the cost of living, which is another way to think about inflation.

Economists believe that the "target" annual inflation rate should be 2%. In other words, if you can buy a bag of groceries for $100 today, then you'll need $102 next year to buy the same bag. If inflation increases to 3% the following year, then you'll need $105.06 to buy the same groceries two years from now. The formula is really simple:

Future price = Today's price x Inflation rate

For this to work mathematically, we express the inflation rate as 1 + r. So, 2% inflation is 1.02. If you want to calculate a future price after several years of inflation, just keep multiplying by the annual inflation rate. In the example above, we would calculate: $100 x 1.02 x 1.03 = $105.06.

This is the same calculation that we use to determine what a previous amount of money is worth in "today's dollars." To calculate how much stuff $1 in 1950 could buy today, multiply $1 by all the reported inflation rates from 1950 to 2020. Or, you can just use an inflation calculator, which does it for you. Today, you would need $10.70 to buy the same amount of stuff that you could buy in 1950 for $1.

A Viral Meme on Minimum Wage Is Wrong

The following is a meme about the minimum wage that went viral on Facebook:

The authors are trying to make the point that the federal minimum wage is worth less and less over time. Specifically, they are arguing that the minimum wage is not keeping up with inflation. Though they are correct, the last figure is wildly wrong. (Their other figures are a bit off, but not as badly as the final figure.)

Without even calculating anything, look at the number. The meme is claiming that the equivalent of $7.25 in 2009 is $6.11 in 2020. That's going the wrong way. Inflation causes prices to increase over time, not decrease. This figure could only be true if prices fell between 2009 and 2020. They did not; they increased by 20.2%. In reality, a person making $7.25 per hour in 2009 would need to make $8.71 today to purchase the same amount of stuff.

Federal Minimum Wage Over Time

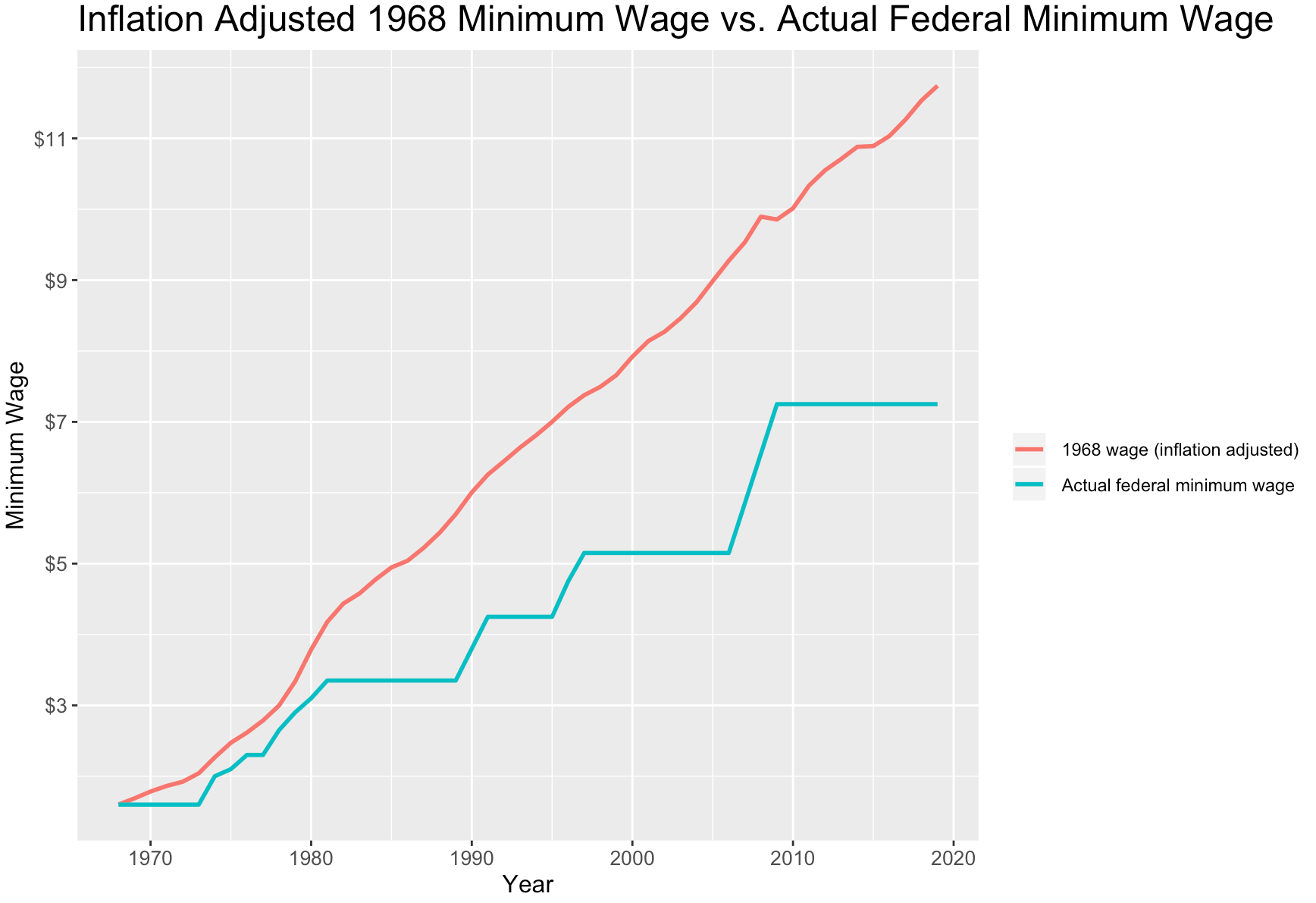

For the sake of argument, let's assume that the $1.60 minimum wage in 1968 is fair and that today's federal minimum wage should be equivalent to that. After adjusting for inflation, the equivalent wage today would be about $11.85. Below is a plot of the 1968 wage inflation adjusted over time compared to the actual federal minimum wage.

As shown, the federally mandated minimum wage has not kept up with inflation. Regardless of where one stands on this issue (i.e., whether the federal minimum wage is too high, too low, or shouldn't exist at all), one's position at least requires getting the math right.

Sources