GoFundMe is perhaps the most popular crowdfunding platform, and it was the source of data by researchers trying to understand how crowdfunding plays into accessing healthcare.

GoFundMe

- “controls” 90% of the crowdfunding market

- Roughly a third of campaigns are for medical needs

- Those initiated campaigns, which total 250,000, annually raise more than $650 million

- In 437,596 campaigns over four years (2016-2020), GoFundMe raised more than $2 billion. (Unfortunately, the goal was $8.45 billion. This fact intrigued the researchers and informed their study.)

Using GoFundMe data from 2016 to 2020, researchers wanted to “examine use, rates of success and inequalities of returns.” The GoFundMe platform is not transparent; its algorithms push up the more successful campaigns and demote the less successful. For reasons of privacy and proprietary data, the platform doesn’t provide direct access to their data. Instead, the researchers search the platform using zip codes. Because old campaigns fade away, the 2020 data is the basis of their analysis, but they could summarize older campaigns. They identified roughly 438,000 campaigns since 2016 (196,000 in 2020) with publicly accessible data. Zipcodes provided data on the percent who were uninsured; those with medical debt; and per capita earnings.

- Median campaign earnings were $1,970 towards an $8,000 goal (24.6%) from an average of 24 donors

- 16% were entirely unfunded; 50% reached 25% of their goal; 33% came halfway to their goal; and less than 12% of campaigns were fully funded.

- From 2016 to 2020, goals and donations declined, more precipitously in 2020 [1]

- There was increasing inequality over the same period, with more unfunded campaigns and smaller donations offset by more donors.

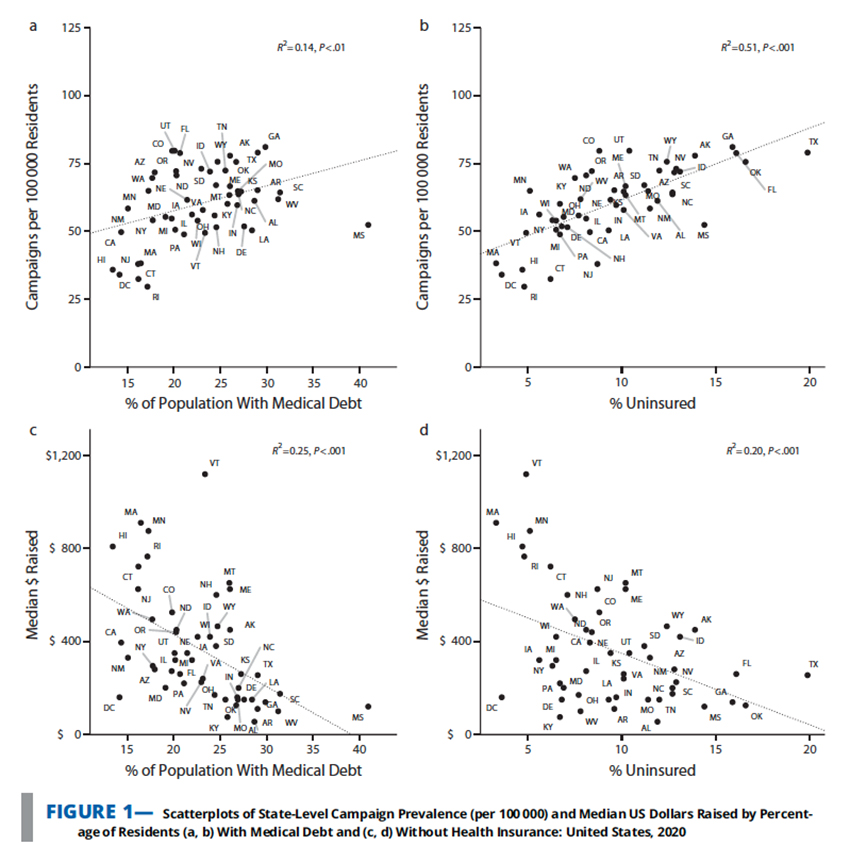

“Thus, while medical crowdfunding is more common in states with lower insurance coverage and higher medical debt, campaigns in those states raised less money.”

This graphic captures the study’s key findings:

The prevalence of campaigns increased with increasing medical debt and a lack of insurance. No surprise there. But as those bottom two scatterplots show, rising debt and lack of insurance resulted in declining median contributions. The highest likelihood of success were campaigns initiated in high-income areas, where perhaps more discretionary income was available.

“…medical crowdfunding’s impact on public attention and engagement far outpaces its contributions toward health expenditures.”

GoFundMe is a feel-good experience for many and helpful for a few, but it is not a safety net by any stretch of the imagination. It's more of a safety lottery. And a lottery that is “rigged” toward those in higher-income communities. The researchers describe crowdfunding as offering “not a net, but a trampoline, launching them towards significant financial support.” GoFundMe successes are touted, whiile its failures quietly fade away, whether due to the users taking them down or the algorithm demoting their appearance.

The researchers suggest that crowdfunding platforms be more transparent, which is an important goal for any safety net, digital or analog. But if we wish to end financial hardship from healthcare, we will have to expand coverage – the actual safety net.

[1] Two possible drivers of the 2020 plunge were more competition for funding, and of course, COVID-19 impact on personal economies.

Source: Medical Crowdfunding and Disparities in Health Care Access in the United States, 2016–2020 American Journal of Public Health DOI: 10.2105/AJPH.2021.306617