In a sleepy moment, I had an inspiration.

Funding a pull incentive for antibiotic R&D in the U.S. – like a market entry reward, for example – would be more attractive to our representatives in Congress if we required that all manufacturing and supply chains for the beneficiary product be physically located in this country.

Great idea, right? Not exactly.

I raised this with two biotech CEOs. Both, politely, told me I was out of my mind.

The U.S. currently does not have a sufficient small molecule manufacturing infrastructure to either (1) provide for the entire manufacturing chain from API to finished product, or (2) have sufficient availability of raw materials here. This is an especially acute problem for the manufacture of B-lactams (like penicillins and cephalosporins) which must be physically separate from all other drug manufacturing facilities because of concerns over allergic reactions.

This then leads to another thought. The U.S. needs to invest in pharmaceutical manufacturing infrastructure. Now there’s a novel idea(?). The investment must include everything from the provision of raw materials to the manufacturing of a finished drug product, including packaging and labeling.

When I first started working in the industry in the 1990s, we were actually able to do this for some drugs, but rarely for B-lactams. My understanding is that today, as a result of competition from places like India, China and even the U.K. and Europe, U.S. small molecule pharmaceutical manufacturing is nothing like it was 25 years ago. Of course, the problem is not just an antibiotics issue – this problem extends to all drug classes. And the U.S. is not the only country that wants its drug supply chain to be domestic; India and China often insist on it. The global experience with the manufacture and distribution of vaccines for COVID-19 has emphasized the urgency of this problem.

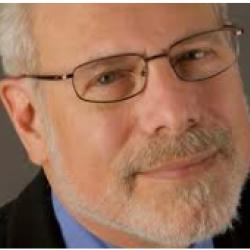

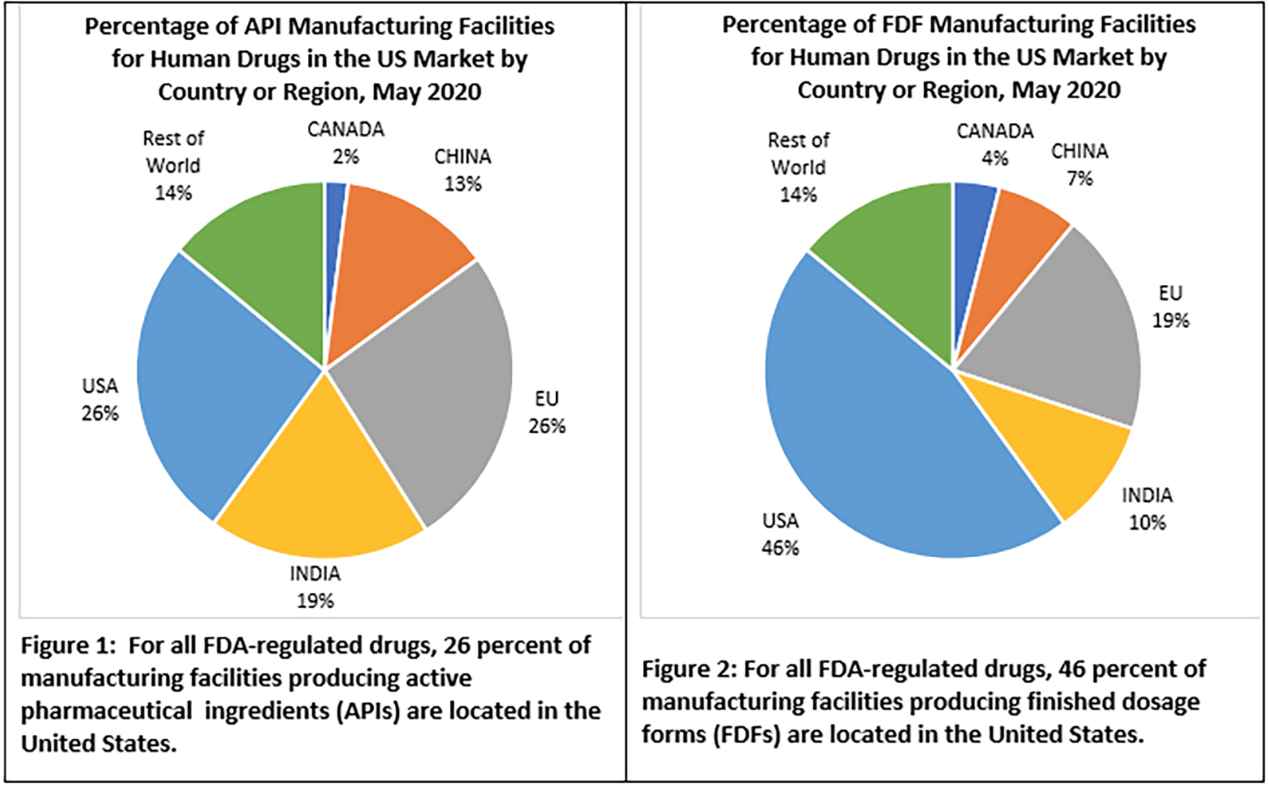

This topic has been the subject of a number of articles (1,2,3) and of a report from the FDA. Last year, the FDA released data on drug manufacturing. Only 28% of API (raw drug powder) for the U.S. market is manufactured here while the E.U., China and India account for most of the rest. I have not seen data on the global distribution of the supply of raw materials for API production – but I suspect, that again, there are few U.S. suppliers. Forty-six percent of the final drug product (the pills or vials that are actually used) for the U.S. market is made here. I have not seen similar data specific for antibiotic manufacture, but I suspect the situation is no better and maybe worse.

Of course, adding U.S. manufacturing capacity to bolster our domestic drug supply chain is a good idea. All that is required is money. In the case of antibiotic manufacture, the need may be even more critical.