“The future of care delivery is fundamentally evolving to become patient-centric, virtual, ambulatory, in the home, value based and risk bearing, driven by data and analytics, transparent and interoperable, enabled by new medical technologies, funded by private investors, and integrated yet fragmented.”

There are many buzzwords in that quote, and when you get into the meat of the matter, to use an MBA term, few deliverables. Let’s break it down a bit.

Patient-centric – That, of course, is the basis of medical care, the one-on-one encounter between patient and physician (or now provider). So nothing new here. They do carve out an area where more and more patients want to be able to schedule and change appointments, see medical notes and tests and renew medications online. A win-win for physicians, it moves these front office chores to automation – yes, the patients will be “chatting” with an algorithm. For patients, a sense of control, well, pseudo power when they find a laboratory value or report that requires a human explanation.

Patient-centric – That, of course, is the basis of medical care, the one-on-one encounter between patient and physician (or now provider). So nothing new here. They do carve out an area where more and more patients want to be able to schedule and change appointments, see medical notes and tests and renew medications online. A win-win for physicians, it moves these front office chores to automation – yes, the patients will be “chatting” with an algorithm. For patients, a sense of control, well, pseudo power when they find a laboratory value or report that requires a human explanation.

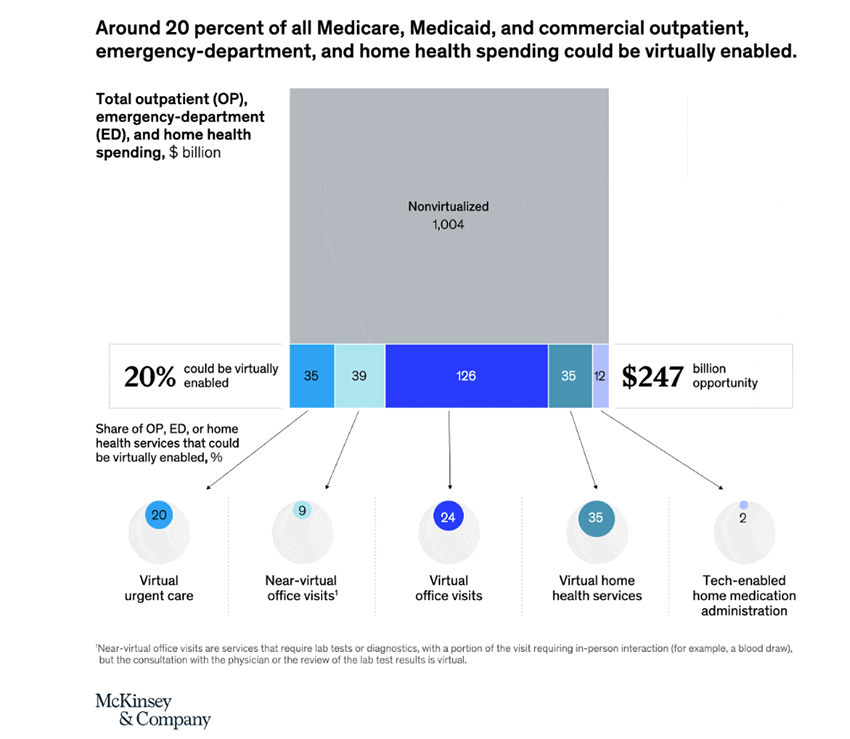

Virtual – remote medical appointments surged during COVID, no doubt about it. That is what is depicted in that graphic. But a few quick caveats. The near-virtual visits are only partially virtual; you still have to get up and go to the laboratory or imaging center. And for those virtual home services, unless you have a way to virtually help someone get dressed, use the bathroom and eat, that is smoke and mirrors to the uninformed investor getting this pitch.

Ambulatory – the move out of hospitals and into ambulatory care centers with far less overhead costs has been underway for years, with physicians leading the way. It remains the only way for physicians to counter the loss of income from declining fees-for-service. Of course, as I have suggested in the past, taking all the high-margin work into the ambulatory centers will financially hurt, if not cripple, hospitals that must provide all care 24/7/52.

In-the-home services – like routine care, dialysis, medication infusions, and my favorite, the hospital-at-home model. There will definitely be growth here. House calls ended because there was so little a physician could do in someone’s home compared to a hospital in the 20s and 30s. We can do a lot more today in a home, and we can send a physician extender in to deliver a straightforward service, like an infusion. I have some second-hand experience with home peritoneal dialysis, and it sounds better than the actual day-to-day. Not only do you need to understand and practice sterile techniques, but you need a place to store and dispose of many liters of dialysis fluid a month. Many of the people who might be candidates for such care have no family member who can actually provide those services.

Value and Risk-based care – again, another longstanding trend. While health systems have been quick to jump on the value incentive, they are not so quick to pay penalties that come with risk-based payments. More importantly, unless you are a large insurer with a group of actuaries at your command, you can’t calculate risks well enough not to hurt financially. That will drive all the providers into large groups or corporations.

Driven by data and technology - our different EHR systems cannot talk to one another after countless billions of dollars. Health care data is messy; in the parlance, it is unstructured, and restructuring is a problem that even Google can’t manage. In its place, we have adopted the fill in the blank, check box approach, and that is why your physician no longer makes eye contact unless you are a screen or keyboard. Technology will undoubtedly be a driver; it is irresistible, shiny, and new. Will the wearables guard your health privacy, or will you trade that away and be served up some health-related ads? Will your medical device be a protected part of the Internet of Things (a now-forgotten buzzphrase), or will it be hackable or subject to ransomware?

Transparent and interoperable – It hasn’t happened yet for electronic medical records, pharmaceuticals, or hospital costs. So this is just words over deeds.

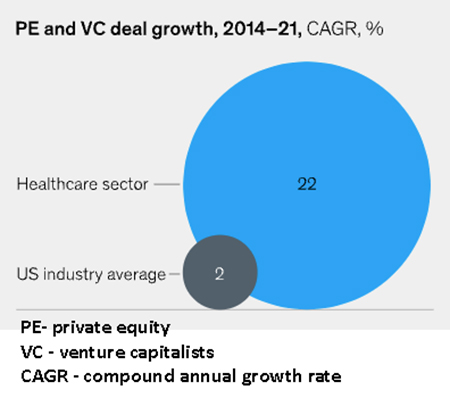

Funded by Private Investors – As the graph clearly shows, healthcare has been a significant investment center for private investors.

Funded by Private Investors – As the graph clearly shows, healthcare has been a significant investment center for private investors.

“For much of the 2010s, investments were focused on consolidation of fragmented assets and optimization of back-end functions. Beginning around 2018, investments in business model expansion became more popular, as seen in bets on platform models or the integration of ancillary offerings.”

The consolidation of fragmented assets means gathering practices like emergency room care into neatly controlled businesses. Do you think that it is a coincidence that concerns over “surprise billing” for out-of-network services involve something PE and VC types have managed? Optimization of back-end functions – welcome to the telephone call chain. “Integration of ancillary offerings,” ah, that add-on, value-added services. Like the chance to shop in the store while you wait for the in-store provider to see you and fill a prescription. Or the possibility of getting a bit of Botox while you wait for your annual examination.

Source: The next frontier of care delivery in healthcare McKinsey&Company [1]

[1] By the way, McKinsey&Company, were among the advisors to the CDC in the rollout of COVID vaccines – enough said.