The study was performed by pragmatists, marketing types looking to understand consumer behavior. With the rise in online grocery shopping, the marketeers wanted to understand how our purchasing “on the app” might differ from the well-honed “buy-me” facilities created in brick-and-mortar stores. They looked at sales receipts of families purchasing groceries online and in person to find answers. They were not only interested in what and how much was bought but in the cornerstone of marketing

“inertial behavior—stickiness in customer purchase or usage choices—stemming from customer loyalty or habit formation.”

The data comes from one of those firms making money selling information on your behavior, Numerator. The researchers looked at 4,388 households making at least one purchase from Instacart, which has 50% of the grocery delivery market. Overall, these households had nearly 2 million shopping transactions between 2019 and 2021.

Here are some data points:

Here are some data points:

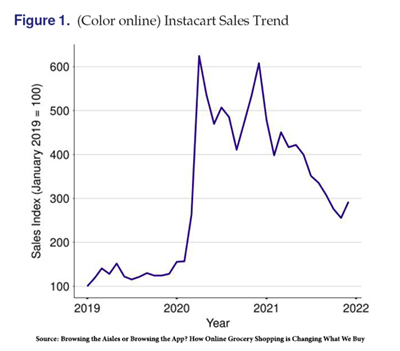

- Brick-and-mortar stores account for 87% of expenditures, Instacart 4%, and the remainder other online sources, e.g., Amazon, Walmart, Target, and Kroger. There was a clear bump in online sales associated with the pandemic, but even with the subsequent decline, online sales have increased significantly.

- Households concentrate their grocery shopping. Two primary brick-and-mortar retailers share two-thirds. Instacart use is even more constricted, confined to those top two retailers.

- Online grocery purchases are less varied, both in the category, e.g., cereal or meat, and within a category, i.e., only one brand.

- Online carts more frequently involve bulk purchases. That results in higher spending for any online vs. brick-and-mortar shopping cart. The decreased frequency of online shopping results in greater brick-and-mortar expenditures.

- The purchases on Instacart have more similarities and overlap than those in brick-and-mortar stores. The researchers suggest that the “buy it again” feature of Instacart moves consumers to repurchase. At the same time, there is far less serendipity involved in cruising the virtual rather than actual shopping aisles. (Interestingly, the loss of serendipity, or novel discovery, was one of the early significant concerns about Amazon when it sold books primarily.)

- Instacart purchases had significantly fewer fresh vegetables. This might have been due to a desire on the part of the purchaser to pick “the best” themselves. On the other hand, Instacart purchases also had much fewer impulse foods; without the strategic placement of temptation, we evidenced stronger willpower. Instacart purchases also had increased in frozen foods.

What might we conclude? Online purchasing seems to reflect regular, bulk purchasing of our day-to-day needs. The researchers define a “characteristic” trip as the weekly trip to stock up. This makes sense because the delay between ordering and receiving, which does not exist in the brick-and-mortar world, favors the replacement of “inventory” that changes slowly. Online purchases of bulk items also may be influenced by where shoppers live. It is arguably far easier for the urban dweller, without a car, to order bulk items delivered rather than try and carry that package of 32 rolls of paper towels home by walking or mass transit.

It is far more interesting to consider the fewer fresh vegetables being purchased along with lesser amounts of impulse foods. This seems to lead to several unanticipated outcomes. My local Whole Foods is what they call a gray store; while it appears to be simply a retail operation, a great deal of the activity in the store is by workers picking and packing online orders. In many instances, they get the jump on actual shoppers who are left to pick through the “remains” of the online picking staff. The second outcome may be that the role of online grocery shopping to fill the urban and rural “food deserts” may not result in more healthful selections.

As to impulse purchases, I suspect they will once again return when a pop-up greets us as we “check out,” the digital equivalent of stocking the area near the register with temptation.

Source: Browsing the Aisles or Browsing the App? How Online Grocery Shopping is Changing What We Buy Marketing Science DOI: 10.1287/mksc.2022.0292