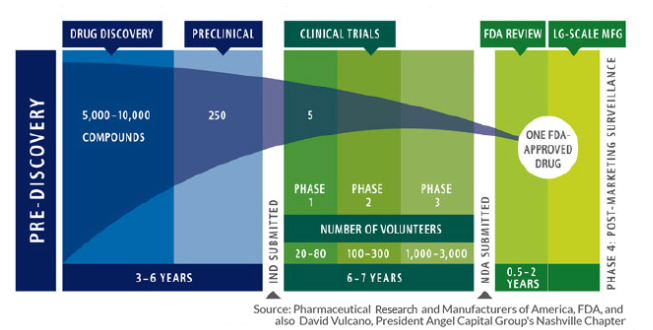

Finding and bring new pharmaceuticals to market is both long and expensive, as my colleague Josh Bloom has written about on many occasions. This infographic sums up the situation pretty concisely.

In those early years, the screening to find interesting or novel drugs can be automated, so the expense of dead ends is not too high. But as you move out of the lab into those Phase One and Two trials, the cost of backing a dead end goes way up; you have to spend a great deal of money on clinical trials that involve patients, physicians, and coordinators. The large pharmaceutical companies often “outsource” these early phases of drug development by purchasing promising start-ups, who have already entered Phase One and Two studies, when risk and cost are more aligned. Good for Big Pharma, and at some point for us, but not so good for those start-ups where funding can become problematic.

One of the areas that suffer this “valley of death” dearth of funding is retinitis pigmentosa (RP). RP is a rare, truly genetic disorder that results in the loss of vision for about 200,000 patients annually. One RP patient, a Washington lobbyist, involved in financing has provided a ground-up solution, Bio-Bonds.

Bio-Bonds, like other financial structures, bundles together a number of risky investments in the hope that by diversifying one will pay off and cover the costs of the others. It is a version of financial insurance, heck, it is the basis of all insurance – spreading risk in the statistical belief that “one hand will wash the other.” A bi-partisan bill before Congress would allow the National Eye Institute to select promising drugs, entering or within that financial valley of death, to receive the proceeds of these bonds. The critical component is a stop-loss for investors if the bonds are not repaid, 50% of the loss will be paid by the Feds – so everyone has skin in the game.

In many ways, it’s a win-win. Start-ups and other early investigations get funded, and the burden, and reward, of that financing, can now be spread about through a broader market, non-pharmaceutical institutions, pension plans, even you and me. Perhaps if we, the people, were the financial winners when a “blockbuster” drug was found, we might feel differently about drug prices, or even lower them.

In many ways, the Bio-Bond bill, formally identified as The Faster Treatments and Cures for Eye Diseases Act, H.R. 6421, is an anomaly. It is bi-partisan, and it was conceived by patients, a ground-up solution, not more of the same investment strategy that puts all the risk, and all the benefit into a small sector of our society. Pharmaceuticals help everyone, doesn’t it make sense that we all have, at the least the opportunity, to invest and support those efforts.

One last thought

I spend a good amount of my time, searching for news and science to share. This particular nugget came from my daughter-in-law, whose co-worker’s, Justin Porcano’s daughter has RP. He wanted to bring both RP and Bio-Bonds to our attention because for him it is now personal. Funding science should be personal for all of us; this is a way we can participate. Take a moment to check out Justin’s website, Savesightnow.org. If you love science, you can do more than read the work of the American Council on Science and Health; you can vote and now, in addition to supporting us, a new way to put “your money where your mouth is.”

Source: Bio-bonds: A new way to invest in the medical miracles of the future