Health care is consolidating. The big mergers, like CVS-Aetna or Cigna and Express Scripts, garner headlines but do not be distracted. It is time to take a look at what might seem to be an innocuous consolidation, specialty medical practices; more specifically, dermatology practices.

Dermatologists care for skin conditions. At the risk of offending my colleagues, there are only a few dermatologic emergencies, primarily severe allergic reactions or manifestations of infection, both better handled in Emergency Departments and hospitals. So, for dermatologists there is not a great deal of emergency call. Other physicians, perhaps in part from jealousy, would describe dermatology as a life-style profession; it certainly is less stressful than general surgery or obstetrics. And they are handsomely paid, according to Doximity, they ranked #6 at roughly $445,000, slight better than cardiologists and slightly worse than my specialty, vascular surgery. And as with many physicians, dermatologists experience “scope creep,” providing care that is not necessarily within the scope of their education; for example, aesthetic management of those wrinkles with fillers or Botox. The point is, not that dermatologists are unnecessary because that is certainly not true, it is just that they are, in some ways, significant “profit centers.”

Dermatologists, like other physicians, have for many years been a cottage industry of small practices and rarely have the expertise or financing to streamline their back-office operations (billing, collections, group purchasing). Management groups have arisen to meet those needs, taking a cut of the “action,” dealing with the vagaries of a small business, and leaving the dermatologist, in this case, to simply practice medicine. But a recent study in JAMA Dermatology identifies a fly in this dermatologic management ointment, private equity investors.

In the last six years, seventeen private equity firms have a moved into the practice management business and control several hundred practices across 30 states.

In fact, my local dermatologist, which has all the appearances of a small-town small practice, is part of a 40-practice management group covering two states. So why the concern?

Private equity firms have large pools of unregulated money which they invest, to make a profit, just like we all might. But private equity often approaches their investments with a short-term, extractive mindset. Acquire a business, restructure and optimize the organization and finances, and then take the money and run. Where once,

“Ownership used to mean dominion over a resource, and responsibility for caretaking that resource.”

Private equity successfully separates ownership and its responsibilities from profit.

I understand the economic need for physician practices to outsource back-office work; others have the expertise to streamline those services better. Management groups still have aligned incentives with their members because results and reputation matter. But private equity investment is not predicated on providing or facilitating medical care; its goal is to turn a profit for their limited pool of investors in as short a time frame as possible.

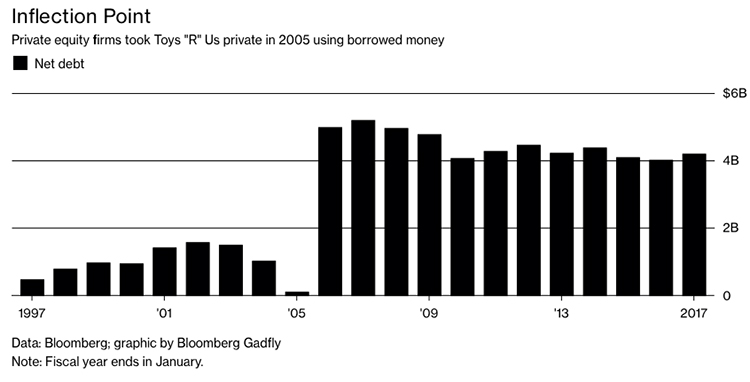

Are all private equity firms predatory? No. But some are, like the three firms that took over Toys R Us in 2005. They loaded that company down with debt to the point that 97% of the nearly $12 billion that Toys R Us brought in, during the last year they were open went to servicing that debt. What responsible owner would do such a thing?

Instead, the private equity investors took what they could and left the remnants to be dealt with by the employees who lost their jobs and the suppliers and vendors who lost their payments.

A self-interest motivated Adam Smith's invisible hand, but it was a self-interest of those who lived and worked in the community, that made use of the community. It was the self-interest of good neighbors, not predators passing through on their way to gated communities. Do we want this to happen to medical practices? Is it appropriate to allow predatory enterprises to invest in essential services?

Sources: Trends in Private Equity Acquisition of Dermatology Practices in the United States JAMA Dermatology DOI: 10.1001/jamadermatol.2019.1634

Lessons Learned from the Downfall of Toys ‘R’ Us

Why Private Equity Should Not Exist