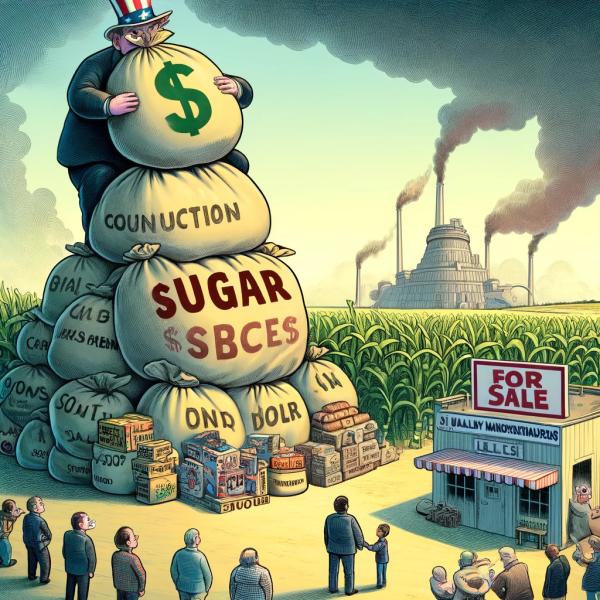

We are one of the largest producers of sugar in the world; however, our demand outstrips our supply. The visible hand of government has intervened in the sugar market for over two centuries. In its first session, the new 1789 Congress introduced the Tariff Act to retire the debt created by the Revolutionary War, promote manufacturing and shipping, and equalize the trading field with Europe. Among its provisions was a 1 cent a pound for brown sugar, 3 cents on loaf sugar, and 1.5 cents for all other sugar. Today’s visible hand has its roots in the Great Depression, which left sugar as our most heavily protected trade good. How and why do we continue to subsidize sugar?

Part of the answer can be found in a report from the General Accountability Office (GAO). The US sugar program is designed to maintain adequate sugar supplies with the least federal expenditures. It has several tools in its toolbox.

- Marketing allotments limit the amount of sugar sold in the US for human consumption by domestic sugarcane and sugar beet processors, thereby maintaining or raising domestic prices. The overall allotment is 85% of the estimated domestic consumption.

- Supports production with loans from the USDA at loan rates established by law (19.75 cents per pound for raw sugar and 25.38 cents per pound for refined beet sugar). The collateral for these loans is sugar, which can be forfeited instead of repaying the loans. The result is a price floor, “incentivizing sugar producers not to sell sugar in the US at a price below the loan rate.”

- To minimize default and further support domestic prices, there are tariffs on sugar importation. There are specific tariff rates with our largest trading partner, Mexico, and World Trade Organization (WTO) countries. These import restrictions help USDA maintain a domestic price of sugar above the USDA loan rate.

Winners

GAO modeling indicates the resulting increase in sugar prices provides $1.4 to $2.7 billion in additional “financial benefits” to sugar producers. Sugar farming is very profitable, with sugarcane farms having a 24.3% greater and sugar beet farms having a 54.2% greater net income per acre than other forms of farming. Because sugar farms are frequently much larger in acreage, this translates to an 8-fold greater net income for the average sugar farm than the average non-sugar farm. And while it is true that farm expenses have increased by roughly 25% since 2017, sugar prices have risen by 44% or more. Finally, there is consolidation. “Because sugarcane farming is highly concentrated, many of the benefits of the US sugar program go to a small number of farmers. …. The largest 1 percent of farms planted 25 percent of all sugarcane or sugar beet acres in 2022.”

The increased production has increased farm jobs by about 4%, while the impact on post-harvest production employment is more mixed. Post-harvest production has also won because of an increase in the net value of refined sugar sales.

And Losers

The net result of a very successful US sugar program is that our wholesale price for refined sugar is double the global price. An estimated loss of between $2.5 and $3.5 billion is borne by refiners, food manufacturers, and end consumers. According to the GAO, half or more of those costs are passed on to us, with the end consumer averaging between $3 and $10 per person. As you might anticipate, those increased expenditures are greater for those purchasing candy and baked goods [1], where more sugar is used, and for low-income individuals who spend a greater portion of their income (30% vs. 8% for the highest income families) on food in general.

There are also job losses as some confectionery production is shifted to lower-cost countries. Modeling suggests only a slight 1% reduction in the bakery workforce but a 34% reduction in the confectionary workers, roughly 18,000 jobs.

A myopic conclusion

I find myself in odd company when thinking about the sugar subsidy. Both the Cato Institute and the Heritage Foundation have significant concerns about the US sugar program. In some ways, they echo the myopic view of the GAO:

“The literature suggests that the negative impact on sugar users outweighs the positive impact on sugar producers, resulting in an estimated overall economic loss to the US economy of $780 million to $1.6 billion per year.”

These market manipulations result in job losses and consumer spending increases, both harmful outcomes for free-market advocates. But let us now play the doctor card. Estimating the healthcare cost of excess sugar consumption is, admittedly, an exercise in Mathmagic. We can torture the data to say whatever we like. But might we all agree that excess sugar in the absence of a balanced diet and a modicum of exercise may lead to a greater risk of chronic illness?

The US sugar subsidy is a classic case of good intentions gone stale. Despite the economic losses and health costs tied to overconsumption, we continue to prop up sugar producers. Maybe it’s time to rethink this not-so-sweet deal.

[1] “The greatest negative effects are most likely in industries where sugar represents the highest percent of material costs: confectionery manufacturing; dry pasta, dough, and flour mixes; breakfast cereal; and cookie and cracker manufacturing.”

Source: Alternative Methods for Implementing Import Restrictions Could Increase Effectiveness Government Accountability Office.