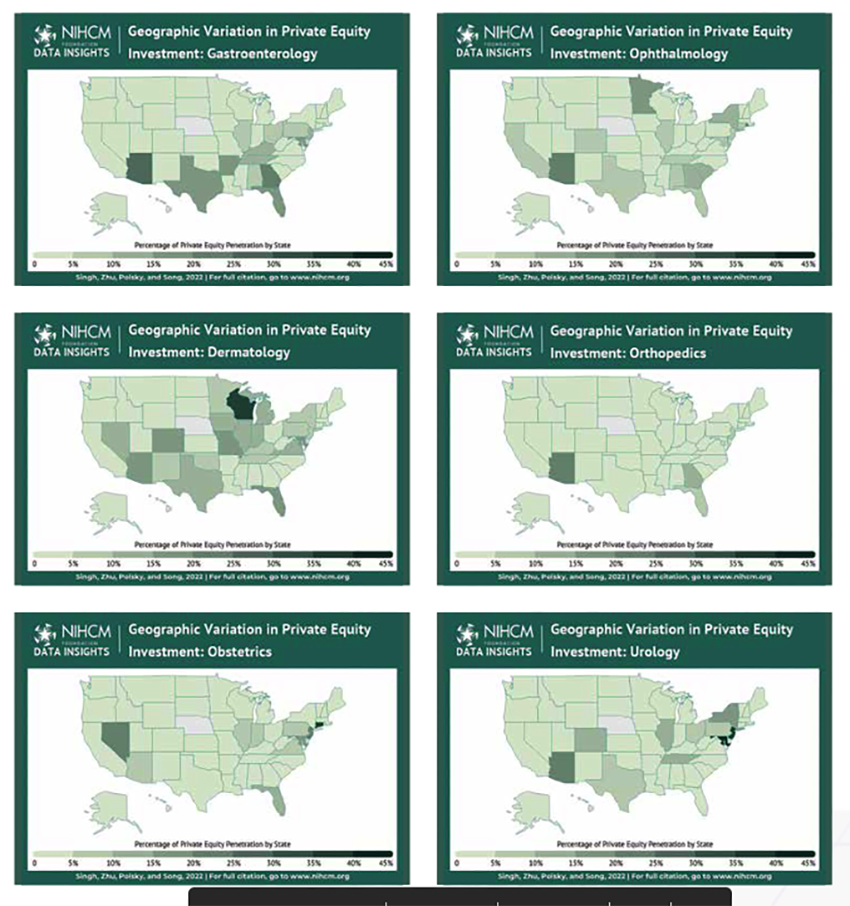

Healthcare is not a free market; through consolidation, driven by mergers and acquisitions, sometimes fueled by private equity, healthcare is becoming more monopolistic than a free market of many. A new report from the National Institute for Health Care Management looks at the geographic distribution of private equity investment across six medical specialties, urology, orthopedics, gastroenterology, dermatology, obstetrics, and ophthalmology.

The specialties chosen are heavy with procedures or have investments in ambulatory surgery centers that allow them to collect “facility” fees that are far greater than the payments made to a physician for a particular procedure. These are specialties with high-margin items that generally balance out the low-margin tasks and provide a “reasonable” mix of patients and insurers.

The general pattern for these acquisitions is to purchase a “platform,” a small thriving practice that can be expanded, much as McDonald’s might expand their base of stores. The franchises appear in markets where they can grab a significant share, similar to how health systems like Cleveland Clinic, the Hospital for Special Surgery, Memorial Sloan Kettering, and Mt. Sinai (New York) have opened branch offices in Florida. Like the famed bank robber Willie Sutton, they go where the patients (and the money) are to be found. And like those health systems “spin-offs,” the private equity franchises are often a pale version of the care and quality of the original.

The entrance of private equity is not all bad news. They bring business sensibility and discipline to medical practices and can consolidate back-office activity, like billing, human resources, etc., to gain productivity and efficiency. They have deep pockets to capitalize expansion, although, in most instances, this expansion is capitalized with debt rather than their money.

The more significant problem is that private equity is the ultimate in short-termers, in for the short hall. Their goal is not to optimize care; it is to optimize the return on their investment – two goals that are frequently not aligned.

Acquisition of practices has slowed during COVID. Roughly 75% of physicians now work for health systems or hospitals; approximately 5.6% of physicians work for private equity-owned practices. COVID and increasing concerns about life-work balance, and burnout among healthcare workers continue to increase these numbers. The graphic depicts the state of affairs as of 2019.

“Don't it always seem to go

That you don't know what you've got 'til it's gone”- Joni Mitchell

Patients may be drawn to the savings, physicians to the better work-life balance, and private equity to the short-term financial windfall. But one of the cornerstones of medical care is accountability. Do you believe that corporate accountability will be more sincere or remediating than the accountability you have between your physician and yourself?

Source: Geographic & Specialty Variation in Private Equity Investment NIHCM